April 24, 2020 - During March 2020, market volume and volatility increased dramatically, because of the uncertainty about the economic impact of the Covid-19 virus.

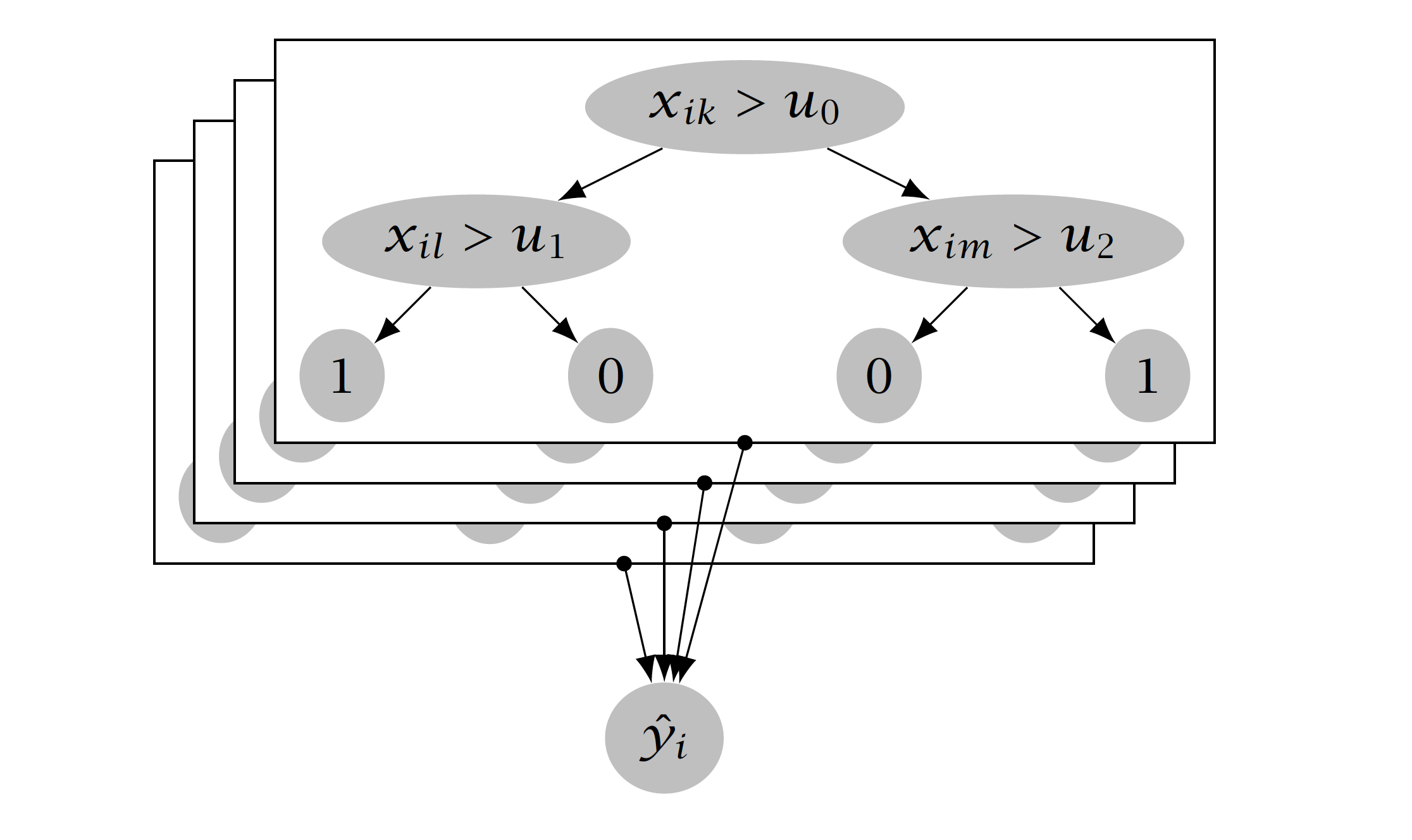

Read MoreMarch 23, 2020 - QB’s research to identify regimes using multidimensional inputs and machine learning to optimize execution. Our methodology provides a blueprint for how to combine algorithmic strategies to drive down costs even in challenging times.

Read MoreOctober 14, 2019 - While certainly not the case with every order, frequent liquidity takers in the CME’s options on futures markets are likely familiar with “vanishing liquidity.”

Read MoreJuly 29, 2019 - The topic of cointegration is not new to finance literature. The hypothesis of cointegrated bond prices has been thoroughly examined by several authors.

Read MoreApril 25, 2019 -When using algorithms to work meta-orders on electronic markets, traders often want to place controls on the algorithm in order to limit the market impact.

Read MoreApril 23, 2019 - Trade-at-Settlement (TAS) on the CME is a listed futures instrument. It permits market participants to trade at a differential to the underlying futures, current day, not-yet-known settlement price.

Read MoreNovember 15, 2018 - We continued our previous study and this time we describe additional variables added to forecast the ten days of the roll period, we also outline our multivariate model used in our forecasts.

Read MoreJune 12, 2018 - Cash Treasuries, unlike most products traded by QB, are available to trade on multiple venues.

Read MoreSeptember 14, 2016 - In response to strong client demand, Quantitative Brokers (QB) has developed a new algorithm called Closer benchmarked to the daily settlement price.

Read MoreFebruary 12, 2016 - Algorithmic futures trading has recently become very popular among the world’s largest commodity trading advisors (CTAs), global macro hedge funds, pension funds and asset managers.

Read MoreAugust 6, 2015 - Different futures products show markedly different distributions of activity across contract months.

Read MoreJune 18, 2015 - On the morning of October 15, 2014, between 9:35 and 9:45 New York time, yields on US Treasury securities underwent their largest single-day drop since 2009, and quickly recovered.

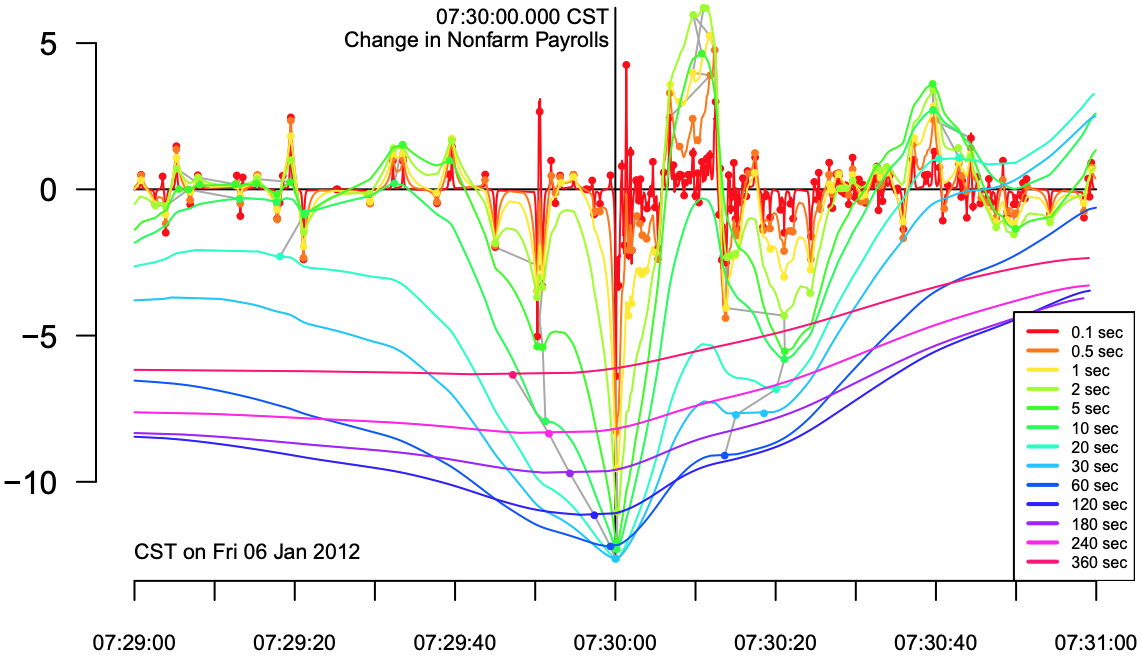

Read MoreJune 11, 2015 - We track 62 unique macroeconomic events and calibrate our volume forecasts to the effect of each data release.

Read MoreJune 9, 2015 - A brief report in the context of the June 9 WSJ article, which discusses a decline in the bids to debt ratio of the 10-year Gilts.

Read MoreMay 30, 2014 - Overall volume has been steadily increasing following a low point at the end of 2008.

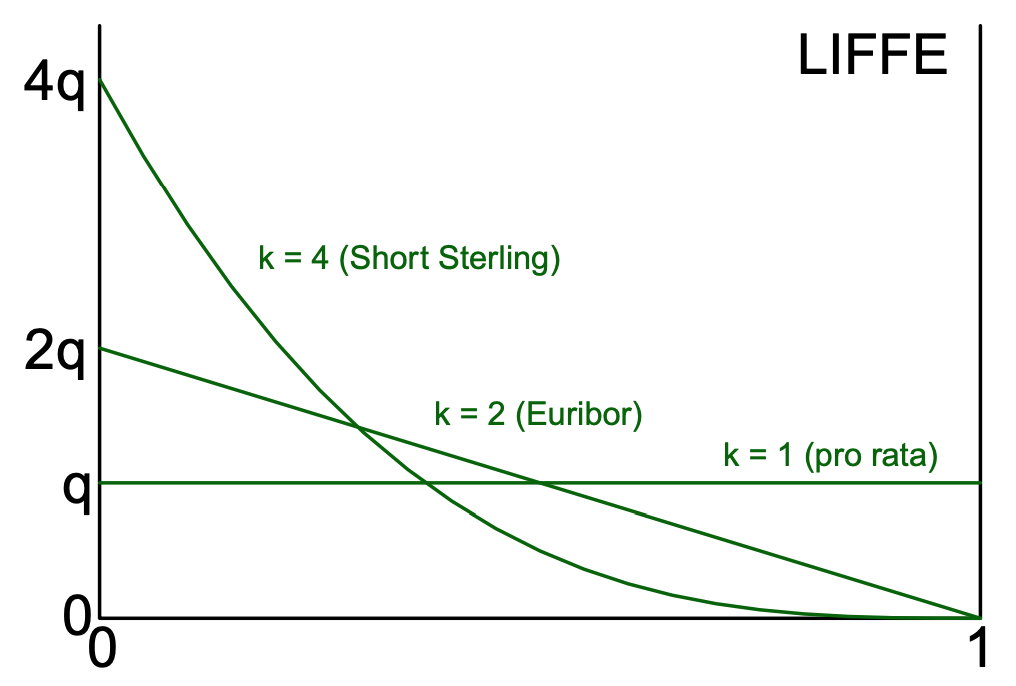

Read MoreMay 31, 2013 - Effective May 29, 2013, the NYSE LIFFE exchange announced a change to the pro rata trade matching algorithm.

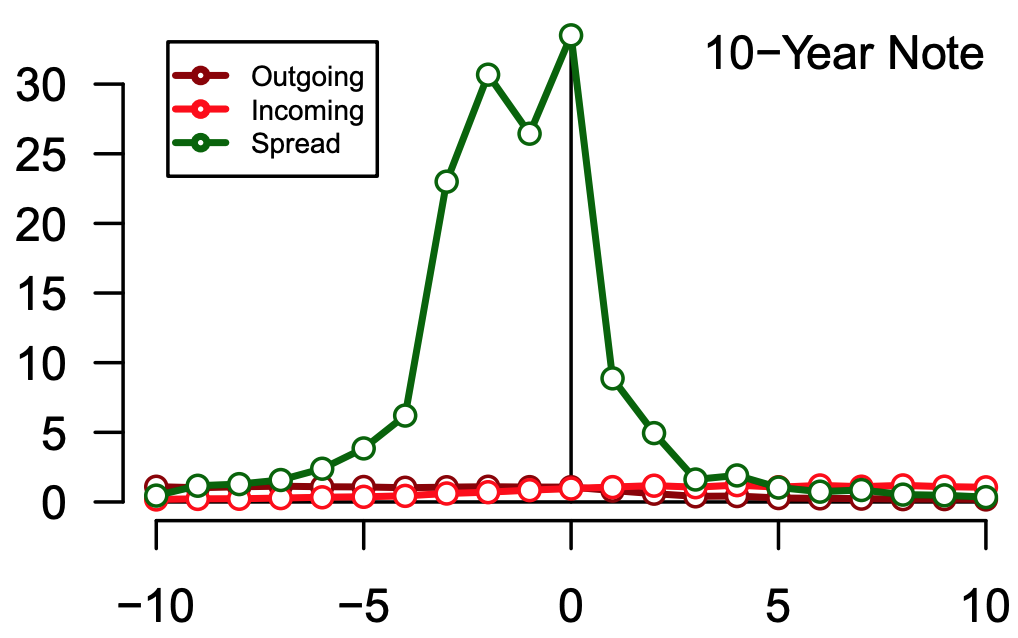

Read MoreJune 26, 2012 - We investigate the effect of scheduled information releases and auctions on high-frequency trading of interest rate futures on the Eurex exchange, and compare with similar products on CME.

Read MoreAugust 25, 2011 - The Treasury futures roll occurs quarterly with the March, June, September, and December delivery cycle of Treasury futures contracts.

Read MoreMay 26, 2011 - We track 62 unique macroeconomic events and calibrate our volume forecasts to the effect of each data release.

Read More